Europe natural gas prices fall on higher Russian and LNG flows

Europe natural gas prices fall on higher Russian and LNG flows

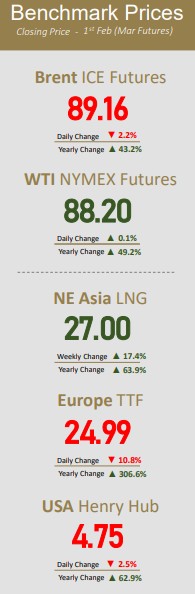

British and Dutch gas prices fell on Tuesday on higher flows from Russia, strong liquefied natural gas supply and with forecasts for warmer weather expected to curb demand. Capacity nominations for supply to Slovakia from Ukraine via the Velke Kapusany border point, a major route for Russian gas deliveries to Europe, rose on Tuesday to their highest point so far in 2022.

Meanwhile, warmer than-normal weather in the UK and northwest Europe is expected to last until Thursday then drop sharply towards normal over the weekend before restoring next week analysts said. U.S. natural gas futures fell more than 2% on Tuesday, breaking a seven session gaining streak, as forecasts pointed to less cold weather over the next two weeks than previously expected. Warmer temperatures in parts of the Midwest encouraged profit-taking after the big move up on Monday, analysts said. However, a rebound could happen based on weather forecasts and developments coming out of Russia and Ukraine, setting the stage for natural gas prices to get a boost in respect for what’s happening with the global natural gas market.

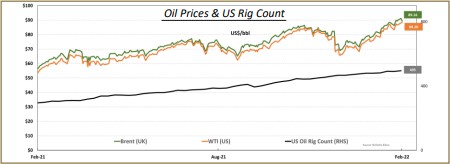

Oil little changed despite possible OPEC+ supply boost

Oil prices ended little changed on Tuesday, as geopolitical tensions and tight global supplies supported the market even as some speculated that OPEC+ might boost supplies more than expected. The Organization of the Petroleum Exporting Countries and allies, together known as OPEC+, is

expected to decide at a monthly meeting today to keep gradually increasing production. Still, sources said an OPEC+ technical panel meeting on Tuesday did not discuss a hike of more than the expected 40,000 barrels per day from March.

Goldman Sachs said that while OPEC+ acknowledge the potential outcome remains evenly balanced between such an accelerated response and a status quo increase, the oil market would likely respond more negatively to the former given the rally over the past two-months. Prices were under some pressure from expectations that this week’s U.S. supply reports will show an increase in crude stockpiles. Analysts expect stocks to have risen by 1.8 million barrels