U.S. natural gas futures edge up

U.S. natural gas futures edge up

…cold slows output return

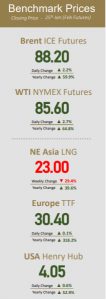

U.S. natural gas futures edged up to a one-week high on Tuesday as cold weather this year has slowed the return of some output. Meanwhile, the amount of gas flowing to U.S. LNG export plants has averaged 12.5 billion cubic feet per day (bcfd) so far this month, which would top December’s monthly record of 12.2 bcfd, reinforcing the position of the United States as the world’s No. 1 exporter of liquefied natural gas.

Traders said demand for U.S. LNG will remain strong so long as global gas prices keep trading well above U.S. futures as utilities around the world scramble for LNG cargoes to replenish low stockpiles in Europe and meet surging demand in Asia.

British and Dutch gas prices rose on Tuesday, with forecast warmer temperatures dampening demand, while continued fears over a possible invasion of Ukraine by Russia provided support.

Analysts expect European gas prices remain highly volatile and sensitive to weather risk, unexpected supply changes and geopolitical uncertainties. The analysts also said rising prices of LNG in Asia could start to stem the flow of tankers coming to Europe which would also be bullish for prices.

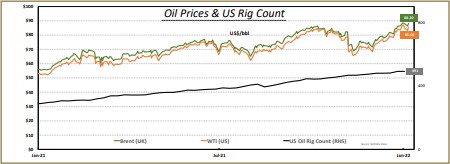

Oil price rises on concerns of potential tight supply

Oil prices rose over 2% on Tuesday on concerns supplies could become tight due to Ukraine-Russia tensions, threats to infrastructure in the United Arab Emirates and struggles by OPEC+ to hit its targeted monthly output increase. Analysts said that geopolitical risks sent crude prices higher as a tight oil market that is already battling low inventories seems

Oil prices rose over 2% on Tuesday on concerns supplies could become tight due to Ukraine-Russia tensions, threats to infrastructure in the United Arab Emirates and struggles by OPEC+ to hit its targeted monthly output increase. Analysts said that geopolitical risks sent crude prices higher as a tight oil market that is already battling low inventories seems

vulnerable to shortages in the coming months. Analysts also noted that oil prices rose despite a drop in equities markets and the possibility of an interest rate hike by the U.S. Federal Reserve on Wednesday. In Iran, meanwhile, talks to revive a 2015 nuclear deal with Western powers were approaching a dangerous impasse, British Foreign Secretary Liz Truss said on Tuesday. Success in those talks could result in the lifting of sanctions on Iran and more barrels of Iranian oil for world markets. Lower U.S. oil inventories are also providing support, with crude stocks at their lowest for the time of year since 2012. The market is waiting for the official U.S. inventory report to be released today by the EIA.

………………………………………………………………………………………………………………………………………………………………

All Data Quoted Source: Mediterranean Gas Energy Research Division, OPEC, ABHAIF. Copywrite 2022. All Rights Reserved Mediterranean Gas S.A.

Volos, Thursday, 27th January 2022